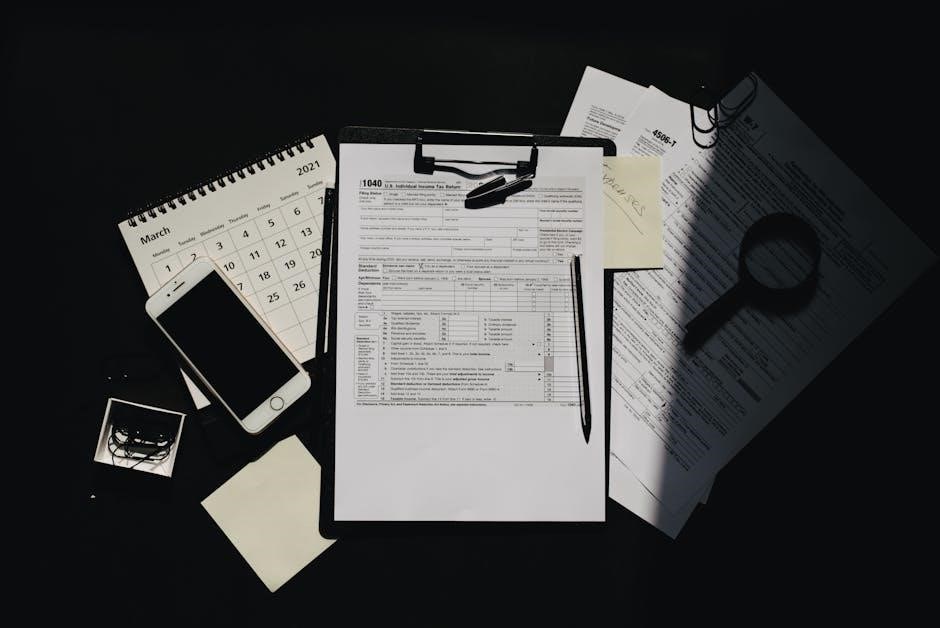

Form 5471 and Schedule O are essential IRS forms for U.S. taxpayers with foreign corporate interests. Schedule O specifically reports organizational changes and stock transactions.

1.1 Overview of Form 5471

Form 5471 is an information return required by the IRS for U.S. persons with ownership or control in certain foreign corporations. It is used to report detailed information about these corporations, including their operations, income, and U.S. shareholders. The form satisfies the reporting requirements under Internal Revenue Code sections 6038 and 6046. U.S. persons, such as officers, directors, or shareholders, must file this form annually. Failure to comply can result in penalties, including $10,000 per year for late or incomplete filing. Form 5471 is crucial for ensuring transparency in international tax reporting and preventing tax evasion.

1.2 Purpose of Schedule O

Schedule O is a critical component of Form 5471, serving to report the organization, reorganization, or acquisition/disposition of a foreign corporation’s stock. It ensures detailed disclosure of structural changes, financial statements, and stock ownership. This schedule is essential for tracking transactions that affect the foreign corporation’s operations and compliance with U.S. tax laws. By providing a comprehensive overview of these activities, Schedule O helps the IRS monitor international transactions and enforce tax regulations effectively. Its purpose is to maintain transparency and accountability in cross-border corporate activities, ensuring accurate reporting and compliance with IRS requirements.

1.3 Importance of Compliance

Compliance with Form 5471 and Schedule O is crucial to avoid severe penalties and ensure accurate reporting of foreign corporate activities. Failure to file or incomplete submissions can result in fines of up to $10,000 per year and per foreign corporation. Timely and accurate reporting ensures the IRS can assess international transactions properly, maintaining transparency and adherence to U.S. tax laws. Compliance also prevents indefinite audit periods, as unfiled forms keep tax returns open for review. Adhering to these requirements is essential for maintaining legal and financial integrity, especially for U.S. persons with foreign corporate interests and obligations.

Understanding Schedule O

Schedule O is a component of Form 5471 used to report organizational changes, reorganizations, and stock transactions of foreign corporations, ensuring compliance with IRS international reporting requirements.

2.1 What is Schedule O Used For?

Schedule O is specifically designed to report the organization, reorganization, or acquisition/disposition of stock in a foreign corporation. It provides detailed information about structural changes, such as mergers, acquisitions, or dissolutions, and tracks stock ownership transitions. This schedule ensures compliance with IRS requirements for transparency in international corporate activities. By documenting these transactions, U.S. taxpayers demonstrate adherence to tax laws and regulations. Accurate reporting is critical to avoid penalties and ensure proper disclosure of foreign corporate activities. Schedule O is a vital tool for maintaining compliance and providing the IRS with a clear understanding of foreign corporate operations and ownership structures.

2.2 Key Transactions Reported on Schedule O

Schedule O captures essential transactions related to foreign corporations, including the formation, reorganization, or dissolution of the entity. It also reports the acquisition or disposition of stock by U.S. persons, detailing ownership percentages and changes in corporate structure. Additionally, any significant events affecting the company’s capital or operational framework must be disclosed. These transactions are crucial for maintaining compliance with IRS regulations and ensuring transparency in international business dealings. Accurate reporting of these activities is vital to avoid penalties and demonstrate adherence to U.S. tax laws governing foreign corporate operations. Schedule O serves as a comprehensive record of these key transactions, providing the IRS with a clear overview of foreign corporate activities.

2.3 Structure of Schedule O

Schedule O is divided into two primary sections: Part I and Part II. Part I focuses on stock ownership and acquisitions, requiring details such as the date of transaction, class of stock, number of shares, and ownership percentages. Part II pertains to financial statements, including income, expenses, and balance sheet information. The schedule also includes columns for reporting the nature of transactions and their impact on the corporation’s structure. Attachments, such as organizational charts and statements explaining complex transactions, may be required. This structured format ensures comprehensive disclosure of foreign corporate activities, aiding the IRS in evaluating compliance with U.S. tax regulations. Proper completion is essential for accurate reporting and avoiding penalties.

Eligibility and Filing Requirements

U.S. persons with 10% ownership or control in a foreign corporation must file Form 5471. The deadline aligns with the taxpayer’s annual return, with extensions possible.

3.1 Who Needs to File Schedule O

U.S. persons, including officers, directors, and shareholders, who own 10% or more of a foreign corporation must file Schedule O. This includes constructive ownership scenarios. Filers must report organizational changes, stock acquisitions, or dispositions. The requirement applies to individuals and entities with control or significant ownership stakes. Failure to file can result in penalties. The deadline for filing aligns with the taxpayer’s annual return, with extensions available. Proper compliance ensures accurate reporting of foreign corporate activities. Examples include U.S. shareholders acquiring 10% or more of a foreign corporation’s stock, triggering Schedule O filing obligations.

3.2 Ownership Thresholds for Filing

The ownership threshold for filing Schedule O is met when a U.S. person owns, directly or constructively, 10% or more of a foreign corporation’s stock. Constructive ownership includes shares held by family members or entities under the taxpayer’s control. This threshold applies to officers, directors, and shareholders. For example, if a U.S. shareholder indirectly owns 10% through another entity, they must file. Meeting this threshold triggers the requirement to report organizational changes, stock acquisitions, or dispositions. The IRS enforces strict compliance, and failure to meet the threshold does not exempt filing obligations. Accurate ownership calculations are critical to avoid penalties and ensure proper reporting.

3.3 Deadlines and Extensions

Form 5471 and Schedule O must be filed by the due date of the taxpayer’s annual income tax return, generally April 15. An automatic six-month extension is available by filing Form 4868. The extended deadline is October 15. If the original due date falls on a weekend or federal holiday, the deadline is the next business day. Penalties for late filing can be severe, with a $10,000 penalty per year for each foreign corporation. Extensions do not waive the penalty for failing to file on time. Taxpayers must ensure timely submission to avoid IRS scrutiny and financial penalties. Consulting IRS guidelines or a tax professional is recommended for compliance.

Completing Schedule O

Schedule O requires detailed reporting of organizational changes, stock transactions, and financial statements. Accuracy is crucial to avoid penalties, ensuring compliance with IRS guidelines and regulations.

4.1 Part I: Stock Ownership and Acquisitions

Part I of Schedule O focuses on detailing stock ownership and acquisitions. Taxpayers must report the total number of shares acquired or disposed of during the tax year, including the dates and nature of these transactions. This section also requires disclosure of the stock’s ownership structure, identifying all U.S. shareholders and their respective ownership percentages. Accurate reporting is critical to ensure compliance with IRS regulations and to avoid penalties related to incomplete or inaccurate filings. Proper documentation, such as stock certificates and transfer records, should be maintained to support the information provided in this section.

4.2 Part II: Financial Statements

Part II of Schedule O requires detailed financial statements, including a balance sheet and an income statement. The balance sheet must list the foreign corporation’s assets, liabilities, and equity as of the end of the tax year. The income statement should reflect income, expenses, and profits or losses for the year. These financial statements must be prepared in accordance with U.S. generally accepted accounting principles (GAAP), unless otherwise specified by the IRS. Accurate and complete reporting is essential to ensure compliance and avoid penalties. Taxpayers must also ensure consistency in accounting methods and properly disclose any significant financial transactions or events impacting the corporation’s financial position.

4.3 Required Attachments and Documentation

Part III of Schedule O requires specific attachments to support the information reported. This includes a detailed organizational chart showing the foreign corporation’s structure and ownership percentages. Additionally, statements regarding the acquisition or disposition of stock, such as purchase agreements or merger documents, must be attached. If the foreign corporation was previously a U.S. corporation, documentation of its tax filings for the past three years must also be included. Failure to provide complete and accurate documentation can result in penalties or delays in processing. Ensure all attachments are properly labeled and cross-referenced to the corresponding sections of Schedule O to maintain compliance with IRS requirements.

Instructions for Each Line

Each line of Schedule O requires precise information, such as stock ownership details, acquisition dates, and financial data. Follow IRS guidelines for accurate and complete reporting.

5.1 Line-by-Line Explanation

Each line of Schedule O serves a specific purpose. Line 1 details stock ownership percentages, while Line 2 reports acquisition or disposition dates. Lines 3-5 cover financial data, such as assets, liabilities, and equity. Proper documentation, including organizational charts and financial statements, is crucial. Ensure all entries align with IRS guidelines to avoid penalties. Accuracy in reporting stock transactions and corporate changes is essential for compliance. Refer to the IRS instructions for detailed explanations of each line to ensure correct filing. Proper completion of Schedule O is vital for meeting IRS requirements and avoiding delays or audits.

5.2 Examples and Scenarios

For instance, if a U.S. shareholder acquires a 50% stake in a foreign corporation, Schedule O must detail the acquisition, including dates and ownership percentages. Another scenario involves a foreign corporation reorganizing, requiring a full breakdown of changes in stock ownership and corporate structure. If a U.S. person sells stock in a foreign entity, the disposition must be reported with specifics on the transaction. These examples highlight how Schedule O captures critical corporate events, ensuring transparency for IRS oversight. Proper documentation and accurate reporting are essential to avoid penalties and ensure compliance with international tax regulations.

5.3 Common Mistakes to Avoid

Common mistakes when completing Schedule O include missing deadlines, inaccurate stock ownership details, and incomplete financial statements. Filers often overlook reporting all acquisitions or dispositions of stock, leading to penalties. Another error is failing to attach required documentation, such as organizational charts or statements or reorganization details. Additionally, miscalculating ownership percentages or not reporting changes in corporate structure can trigger IRS scrutiny. It’s crucial to ensure all transactions are accurately documented and submitted on time to avoid penalties and ensure compliance with IRS regulations.

Penalties and Compliance

Failing to file Form 5471 or Schedule O on time can result in a $10,000 penalty per year and per foreign corporation, keeping your return open for audit indefinitely.

6.1 Penalties for Late or Incomplete Filing

Failing to file Form 5471 or Schedule O on time can result in a $10,000 penalty for each year and each foreign corporation. This penalty applies to late or incomplete filings, and the IRS may impose additional fines if the omission is deemed willful. Furthermore, the taxpayer’s entire tax return remains open for audit indefinitely until the form is properly filed. The IRS enforces these penalties to ensure compliance with international tax reporting requirements, emphasizing the importance of timely and accurate submissions. Taxpayers must prioritize filing Form 5471 and Schedule O to avoid these significant consequences and maintain compliance with U.S. tax laws.

6.2 Impact on IRS Audit

Failing to file or incorrectly filing Form 5471 and Schedule O can significantly impact an IRS audit. The IRS may extend the statute of limitations indefinitely, allowing continuous scrutiny of the taxpayer’s foreign dealings. Incomplete or late filings often trigger heightened audit scrutiny, as they signal potential non-compliance with international tax reporting requirements. Additionally, the IRS may expand the audit scope to examine related financial activities, increasing the risk of identifying additional issues. Taxpayers who fail to meet these obligations face prolonged legal and financial challenges, emphasizing the critical importance of accurate and timely submissions to avoid prolonged IRS oversight.

6.3 Best Practices for Compliance

Adhering to best practices ensures accurate and timely filing of Form 5471 and Schedule O. Consult with tax professionals to navigate complex reporting requirements and avoid penalties. Utilize IRS resources, such as official instructions and publications, to stay informed about updates. Maintain detailed records of foreign corporate activities, including stock transactions and financial statements. Double-check all entries for accuracy before submission. Leverage online tools and tutorials for guidance on completing Schedule O correctly. Ensure compliance with deadlines and extensions to avoid late filing penalties. By following these practices, taxpayers can minimize audit risks and ensure seamless compliance with IRS regulations.

Recent Updates and Changes

The IRS has introduced updated guidelines for Form 5471 and Schedule O, including new schedules and revised reporting requirements for tax year 2023. Stay informed to ensure compliance.

7.1 Latest IRS Guidelines

The IRS has released updated guidelines for Form 5471 and Schedule O, emphasizing accurate reporting of foreign corporate reorganizations and stock transactions. New instructions clarify requirements for acquisitions, dispositions, and organizational changes, ensuring compliance with international tax regulations. Additionally, the IRS introduced separate schedules, such as Schedule H-1, to streamline reporting processes. Taxpayers must review these updates to avoid penalties and ensure timely filing. The revised guidelines also include changes to Worksheet A and Schedule I, reflecting ongoing efforts to enhance transparency and simplify complex reporting requirements for U.S. shareholders of foreign corporations.

7.2 Changes in Reporting Requirements

Recent changes to Form 5471 and Schedule O reporting requirements emphasize enhanced transparency in foreign corporate transactions. The IRS now mandates detailed disclosures for stock acquisitions, dispositions, and reorganizations, aligning with global tax reporting standards. Additionally, new guidelines require U.S. shareholders to report organizational changes more comprehensively, ensuring accurate tracking of corporate structures. These updates aim to prevent underreporting and ensure compliance with international tax laws, reflecting the IRS’s focus on improving the clarity and precision of cross-border financial disclosures.

7.3 Impact of Tax Reforms

Tax reforms have significantly influenced Form 5471 and Schedule O requirements, particularly in cross-border transactions. Changes in international tax laws, such as the implementation of the OECD’s BEPS framework, have led to stricter reporting standards. The reforms aim to curb tax avoidance and ensure fair distribution of taxing rights. Consequently, U.S. taxpayers must now report more detailed information on foreign corporate activities, including reorganizations and stock transfers. These changes ensure that Form 5471 aligns with global compliance standards, fostering transparency and accountability in international tax reporting. The updates reflect a broader effort to modernize tax regulations in response to evolving global business practices.

Resources and Further Guidance

Consult the IRS website for detailed Form 5471 and Schedule O instructions. Additional guidance is available in IRS Publication 519 and through tax professionals or online platforms like IRS.gov.

8.1 IRS Publications and Forms

The IRS provides comprehensive resources for Form 5471 and Schedule O through its official website. IRS Publication 519 offers detailed guidance on international tax reporting. Additionally, IRS Forms and Instructions portal includes updated versions of Form 5471 and its schedules, ensuring taxpayers have the most current information. These resources help taxpayers understand reporting requirements, deadlines, and compliance standards. They also outline penalties for non-compliance and provide examples to aid in accurate filing. By referencing these official materials, filers can ensure their submissions meet IRS standards and avoid potential issues during audits.

8.2 Consulting Tax Professionals

Consulting tax professionals is highly recommended when dealing with Form 5471 and Schedule O. Their expertise ensures compliance with complex IRS requirements, especially for international tax reporting. Professionals can interpret intricate rules, manage documentation, and handle unique scenarios. They also provide guidance on recent updates and changes in reporting requirements. Tax professionals help mitigate risks of errors or penalties, offering peace of mind for filers. Their knowledge of international tax laws and IRS regulations ensures accurate and timely submissions. By leveraging their experience, taxpayers can navigate the complexities of Form 5471 and Schedule O with confidence.

8.3 Online Tools and Tutorials

Utilizing online tools and tutorials can significantly simplify the process of completing Form 5471 and Schedule O. The IRS website offers detailed instructions, downloadable forms, and interactive guides to assist filers. Additionally, third-party tax software and platforms provide step-by-step tutorials and wizards to navigate complex reporting requirements. Webinars and instructional videos are also available, covering topics like organizational changes and stock transactions. These resources help ensure accuracy and compliance, especially for first-time filers. While online tools are invaluable, they should not replace professional advice for complex cases. Leveraging these resources can streamline the filing process and reduce the likelihood of errors or penalties.

No Responses